As drone technology continues to advance and gain popularity, it’s crucial for businesses incorporating these aerial devices into their operations to understand the importance of drone insurance. In this article, we will explore various topics related to drone insurance to help enthusiasts and hobbyists become skilled in this essential aspect of drone usage for businesses.

Why Businesses Need Drone Insurance

With the increasing use of drones in various industries, it is essential for businesses to have drone insurance coverage due to potential liability claims.

Commercial drones, even when operated responsibly, can still be involved in accidents and cause injury or damage to property. A drone crash could result in serious injury to passersby, employees, or clients, or damage expensive equipment or property, leaving the business vulnerable to costly lawsuits.

A comprehensive drone insurance policy can help protect the business from these financial risks, providing cover for bodily injuries, property damage, and legal defense costs associated with any liability claims.

Another reason for businesses to consider drone insurance is the legal requirements surrounding drone usage. In some countries, like the United States, commercial drone pilots are required to have insurance coverage as a part of their licensing process. This requirement is to ensure that businesses operating drones have adequate financial protection in the event of an accident or incident. Failure to comply with these legal requirements could result in fines or suspension of the drone operating license, potentially hindering the business’s operations and causing financial losses.

As drone usage in commercial settings continues to expand, insurance coverage for these sophisticated and often expensive pieces of equipment is becoming essential. Drones are susceptible to theft, damage, or loss during operation, and proper insurance can cover repair or replacement costs, as well as provide financial protection against any loss of income due to a malfunctioning or grounded drone. Moreover, specialized drone insurance policies offer additional coverages tailored to specific industries, such as aerial photography, agricultural surveying, or infrastructure inspection, ensuring that businesses operating drones have the proper protection and peace of mind they need to continue working effectively and safely.

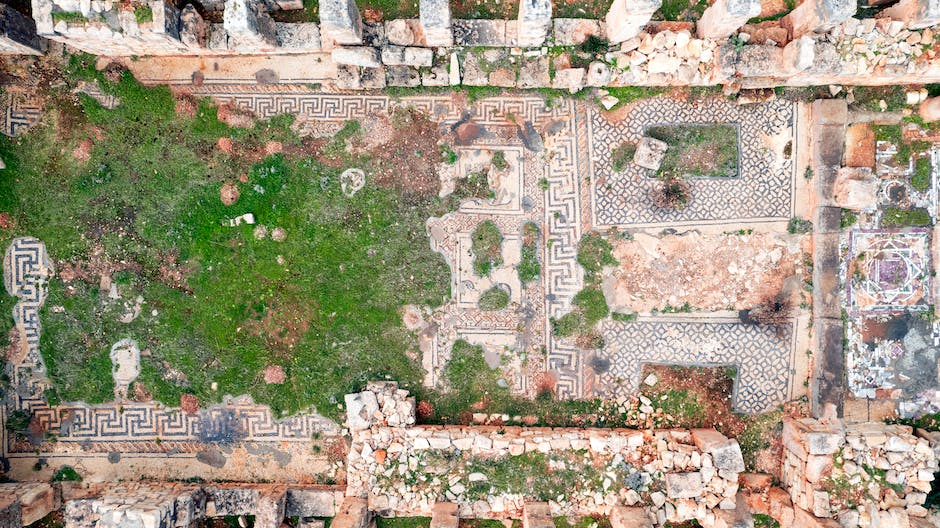

Photo by davidhenrichs on Unsplash

Types of Drone Insurance Coverage

As the world of unmanned aerial systems (UAS) rapidly grows, businesses increasingly rely on drones to carry out various tasks, ranging from agriculture and photography to inspections and deliveries. Consequently, drone insurance becomes crucial for these operations, offering financial protection in case of mishaps while also allowing for smoother and more reliable business processes. By connecting these two factors – comprehensive coverage and industry-specific protection – drone insurance enables businesses to fully capitalize on the numerous benefits and advancements that drone technology offers.

To cater to these needs, various types of drone insurance coverage have been introduced, including hull insurance, payload insurance, and third-party liability insurance.Hull insurance provides coverage for the drone itself, covering damages or a total loss to the UAS due to accidents, theft, or other unforeseen circumstances. This insurance is relevant for businesses that invest in expensive drones or have a fleet of drones, and want to safeguard their investment.Payload insurance, on the other hand, covers the equipment and cargo carried by the drone. This is particularly important for businesses utilizing specialized cameras, sensors, or cargo, as the payload can often be costly and vital to the company’s operations. Third-party liability insurance is often considered a crucial aspect of drone insurance coverage for businesses, as it protects them from potential claims if the drone causes injury to individuals or property damage. These liability policies come with varying limits of coverage, depending on the specific risks involved in the company’s drone operations. Businesses can also opt for additional coverage options, such as personal injury coverage, invasion of privacy coverage, and non-owned drone liability coverage. The latter is particularly advantageous for businesses that rent or lease drones, as it covers possible damages or liabilities arising from the use of those non-owned drones. As drone technology continues to advance and find new applications in various industries, it is essential for businesses to carefully consider the types of drone insurance coverage that best fit their needs in order to mitigate risks and ensure seamless operations.

Selecting the Right Drone Insurance Policy

In addition to determining the types of coverage necessary, businesses must also consider factors such as coverage limits, deductibles, and endorsements when selecting the right drone insurance policy. Coverage limits refer to the maximum amount an insurance company will pay for a covered claim, so choosing limits that accurately reflect potential losses due to accidents, damages, or liability lawsuits is essential. Although policies with higher limits generally offer more protection, they may come with higher premium costs. Deductibles are the amounts a business will pay out-of-pocket before the insurance coverage begins, and selecting a higher deductible can help lower premium costs. However, it is crucial to ensure that the business is prepared to pay the deductible in the event of a claim.

Another important consideration when selecting a drone insurance policy is the scope of coverage and any endorsements or addendums that may be necessary for a particular business. This might include coverage for third-party liability, physical damage to the drone, loss of payload or equipment, and coverage for non-owned or hired drones operated by your business. Be sure to review any policy exclusions that may affect your operations, such as specific geographical limitations, altitude restrictions, or prohibitions on certain types of drone usage like racing or autonomous flight.

Obtaining drone insurance for your business from a specialized provider with expertise in drone risks and coverage options is crucial for comprehensive protection tailored to your specific needs. These specialized insurance providers possess the necessary knowledge about the unique risks associated with drone operations, making them better equipped to recommend suitable coverage options, assess your business’s exposures, and navigate the constantly changing landscape of drone regulations and best practices. As a drone insurance policyholder, partnering with an expert provider will give you peace of mind while minimizing financial loss and liability in case of unexpected accidents or incidents.

Risk Management and Loss Prevention

A critical aspect of risk management for businesses utilizing drones is ensuring proper employee training is in place. It is essential to provide employees with the necessary knowledge, skills, and certification to operate drones safely, which will mitigate potential risks during drone operations. Training should cover the technical aspects of drone flight as well as the legal and regulatory requirements governing their use. Additionally, implementing ongoing training and assessment of pilot proficiency should be part of your risk management strategy. This will ensure that drone operators can effectively handle drone-related emergencies and incidents, reducing the likelihood of potential liabilities and ensuring a smooth integration of the two aspects discussed.

Equipment maintenance is another vital component of a comprehensive risk management plan for businesses incorporating drone usage. Regular inspections and maintenance of the drones and their related equipment, such as batteries, rotors, and controllers, are crucial in reducing the likelihood of equipment malfunctioning, which, in turn, minimizes the potential losses and liabilities resulting from accidents and damage. In addition to routine maintenance, implementing safety protocols such as pre-flight checklists and situational assessments before each flight can further reduce the chance of accidents and incidents during operations.

As an enthusiast or hobbyist looking to become skilled in drone insurance for businesses, it is crucial to understand the importance of risk management through the development of a drone operations manual. This document should clearly outline the company’s policies and procedures for safe drone usage, incorporating guidelines on flight planning, equipment usage, and emergency response procedures, all while adhering to applicable legal and regulatory requirements. Designated safety officers should also be assigned to ensure compliance with the operational manual’s procedures and maintain open communication with all stakeholders involved in drone operations. This proactive approach to risk management can assist businesses in avoiding expensive accidents and liabilities while fostering a safer work environment for both drone operators and the public.

Understanding Drone Insurance Claims

Another essential aspect of drone insurance expertise is comprehending the claims process, which becomes crucial when incidents occur involving a business’ drone or unmanned aerial vehicle (UAV). A seamless understanding of the claims process enables businesses to efficiently and effectively navigate the complex world of drone insurance claims. In the event of an accident, crash, or other drone-related incident, businesses must promptly report the event to their insurance provider. This usually involves contacting the insurance company’s claims department, providing the necessary details of the incident, including date, time, location, and any relevant information. By connecting these two crucial aspects – risk management and insurance claims – enthusiasts and hobbyists can develop a comprehensive understanding of drone insurance for businesses.

In addition to providing the basic details of the incident, businesses should be prepared to submit thorough documentation to support their claim. This documentation may include, but is not limited to, photographs or videos of the accident, invoices or receipts for any repair or replacement costs, and copies of any relevant flight logs or maintenance records. In some instances, the insurance company may send an adjuster or investigator to assess the damage and gather further information. Cooperation with the adjuster or investigator is essential, as their findings will play a significant role in the determination of the claim’s outcome.

Throughout the claims process, businesses should maintain open lines of communication with their insurance provider. This may involve regularly checking in to inquire about the status of the claim, as well as promptly providing any requested documentation. Insurance companies will often take several factors into consideration when determining the outcome of a claim, including the type of coverage the business has, the limits of that coverage, and any applicable deductibles. By familiarizing themselves with their policy and understanding the claims process, businesses will be better prepared to navigate the complexities of drone insurance claims and ensure a successful outcome.

By understanding the different types of drone insurance coverage, how to select the right policy, effective risk management strategies, and the claims process, businesses can make informed decisions when it comes to protecting their assets and reducing potential liabilities related to drone operations. Armed with this knowledge, enthusiasts and hobbyists will be better equipped to navigate the world of drone insurance and contribute to a safer, more responsible drone-user community.

Originally posted 2023-05-26 18:18:20.